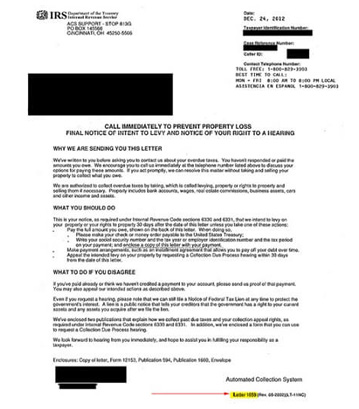

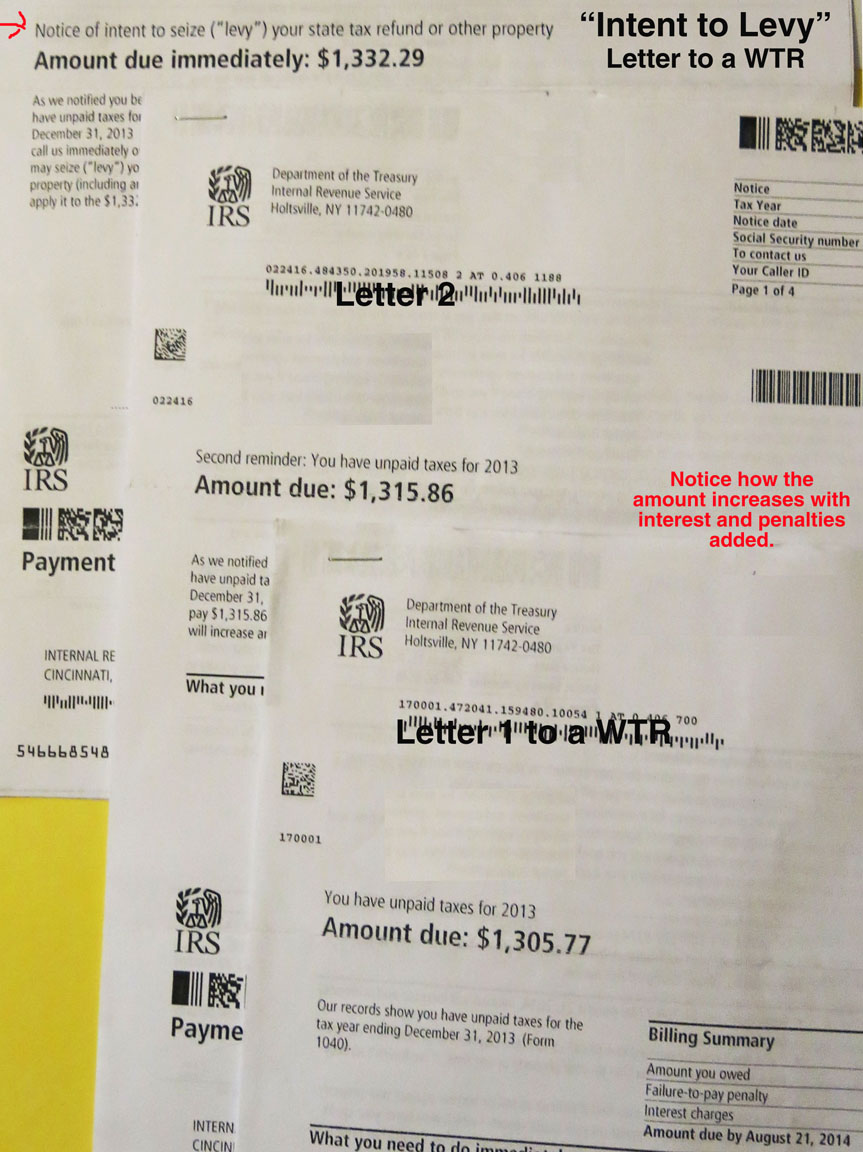

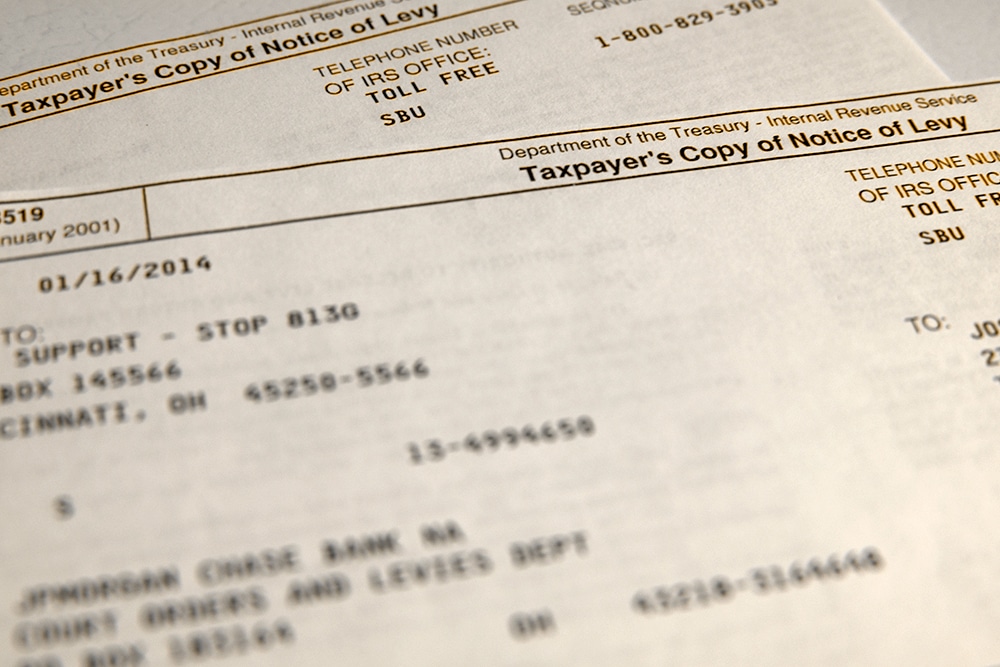

IRS Demand Letters: What are They and What You Need to Know | Tax Resolution Professionals, A Nationwide Tax Law Firm, (888) 515-4829

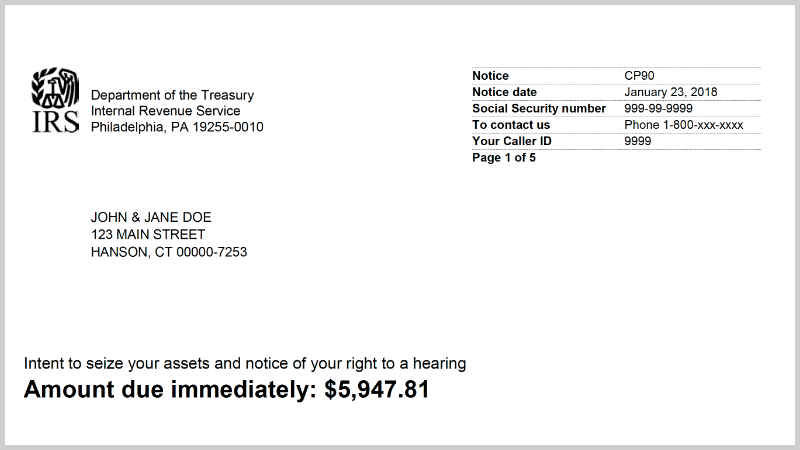

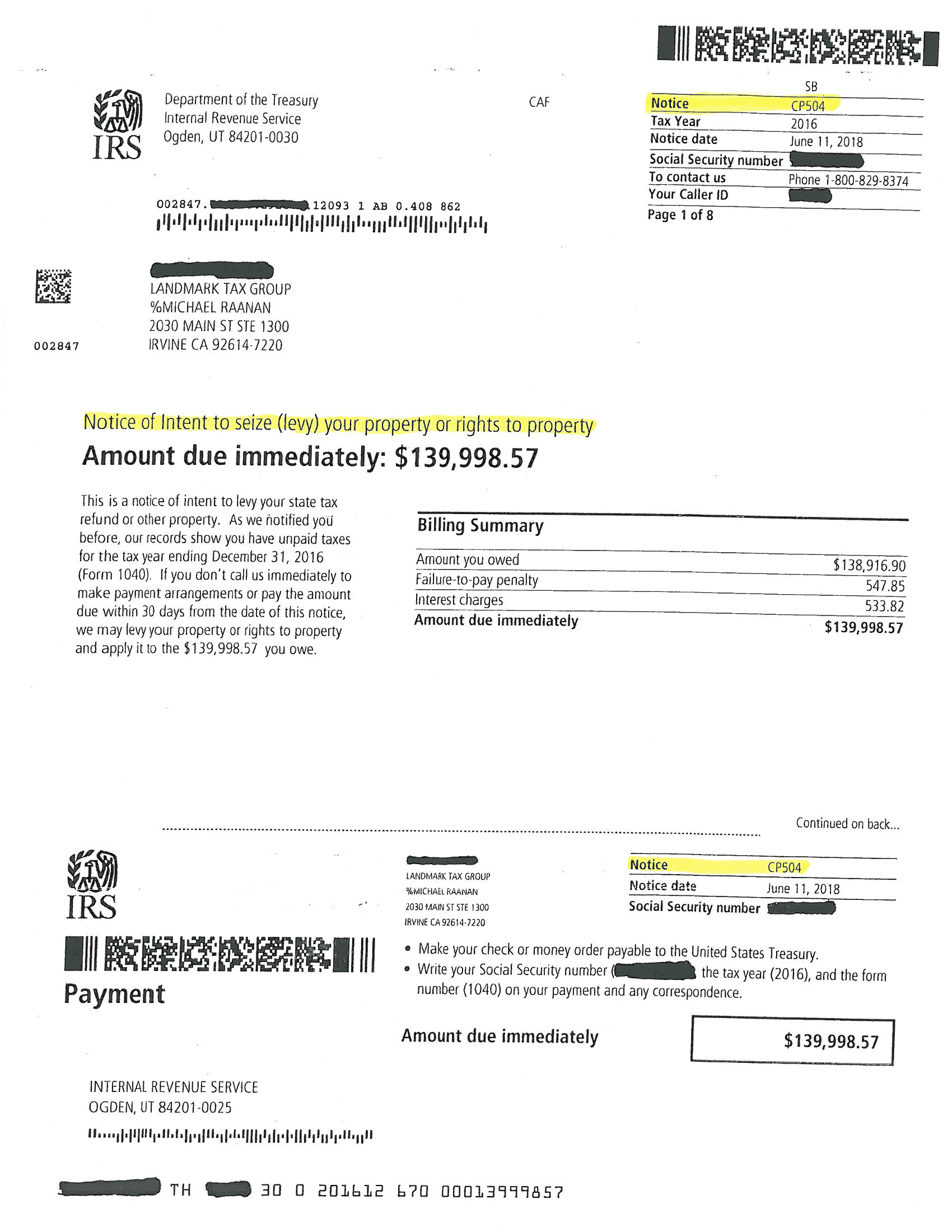

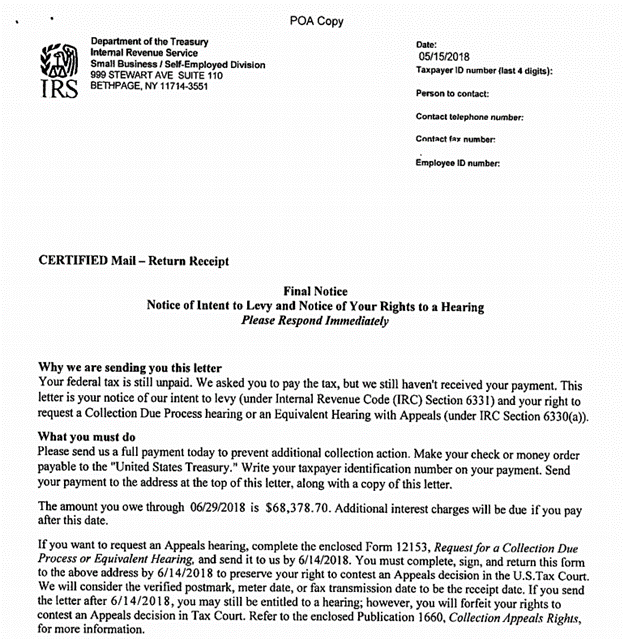

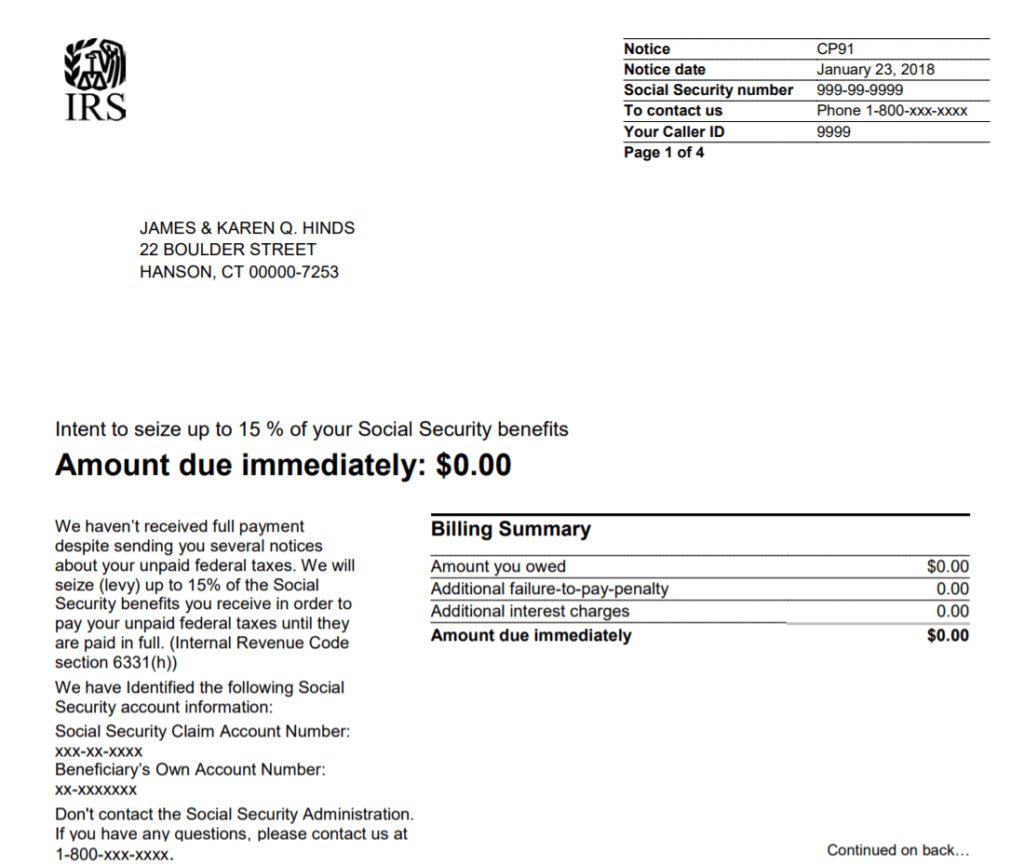

The IRS sent you a Final Notice of Intent to Levy and Notice of Your Right to a Hearing. What should you do now? | Brandon A. Keim - Phoenix Tax Attorney

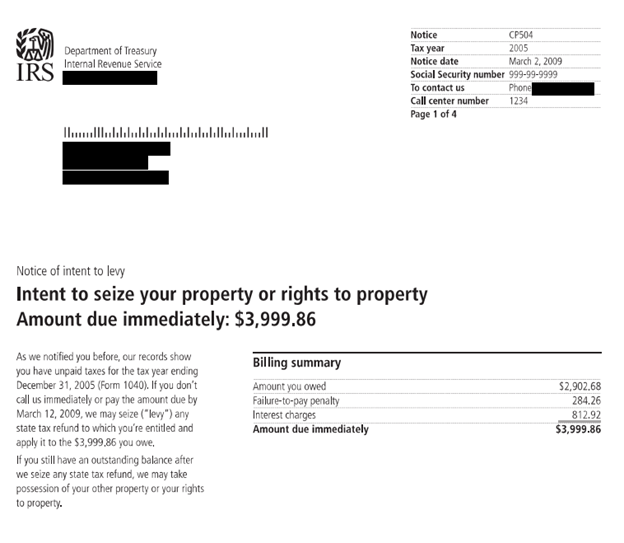

IRS Just Sent Me a Notice of Intent to Levy- Intent to Terminate Your Installment Agreement (CP 523) – What Should I Do? | Legacy Tax & Resolution Services