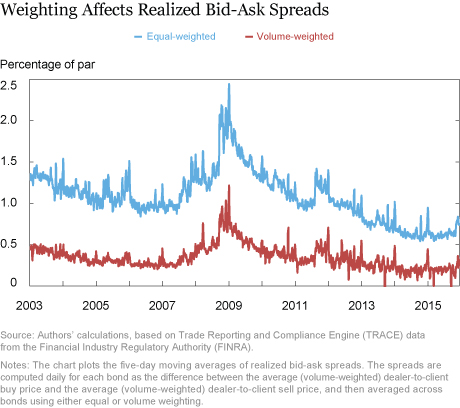

In times of financial stress, what typically happens to the difference between interest rates on corporate bonds and U.S. Treasury bonds? – Education

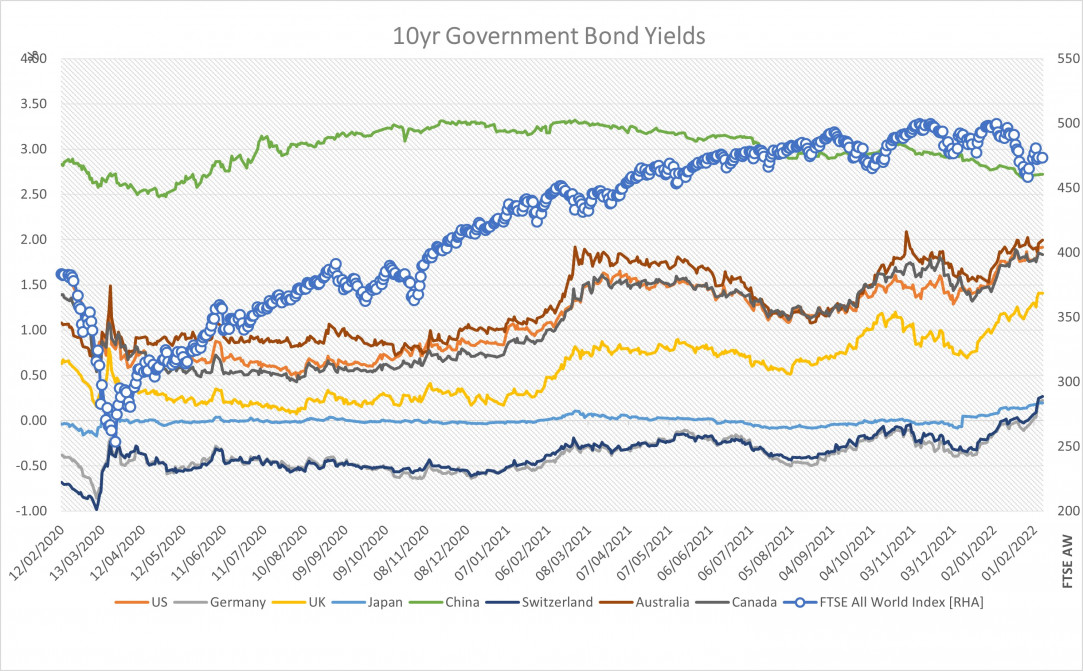

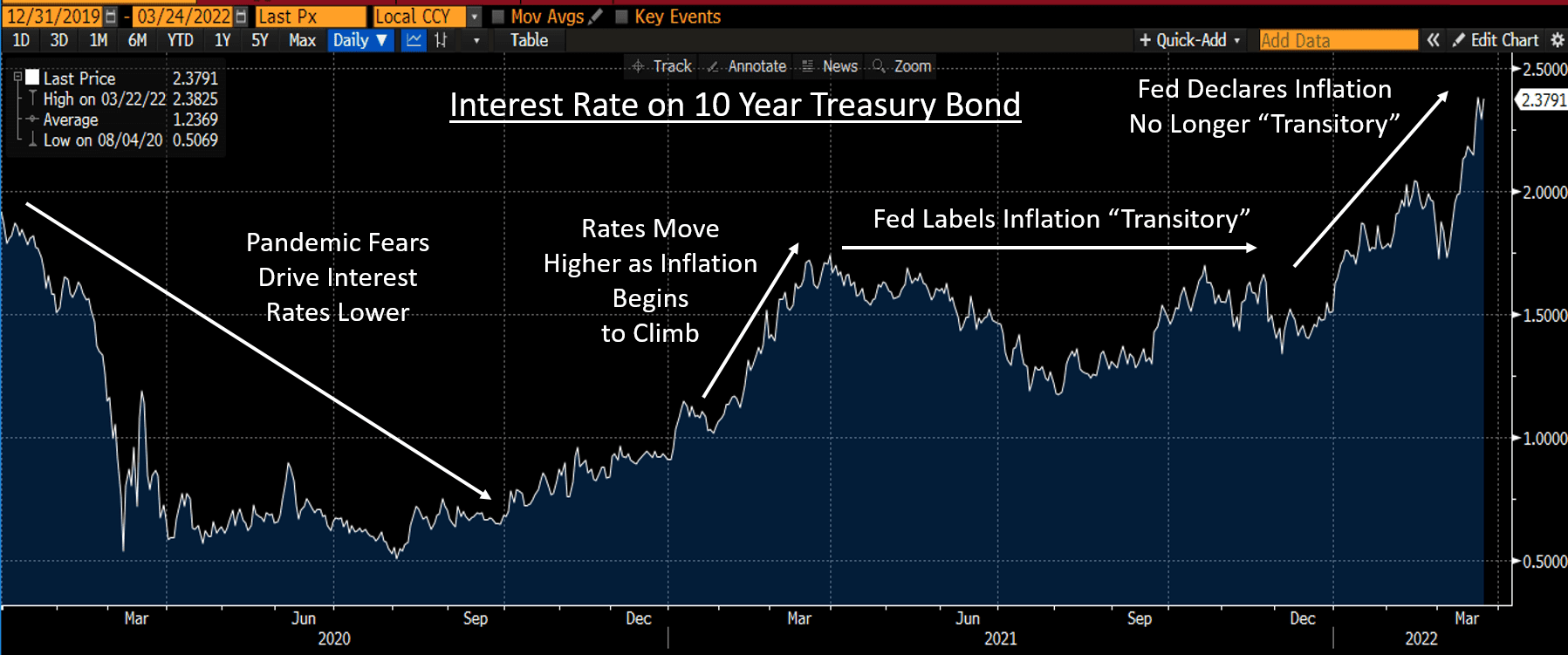

Holger Zschaepitz on Twitter: "The biggest bond bubble in 800yrs continues to deflate after rising US #inflation data (CPI & PPI) shake up the bond markets. The value of global bonds has