PDF) A PDE approach to Asian options: analytical and numerical evidence* 1 | Dyakopu Neliswa - Academia.edu

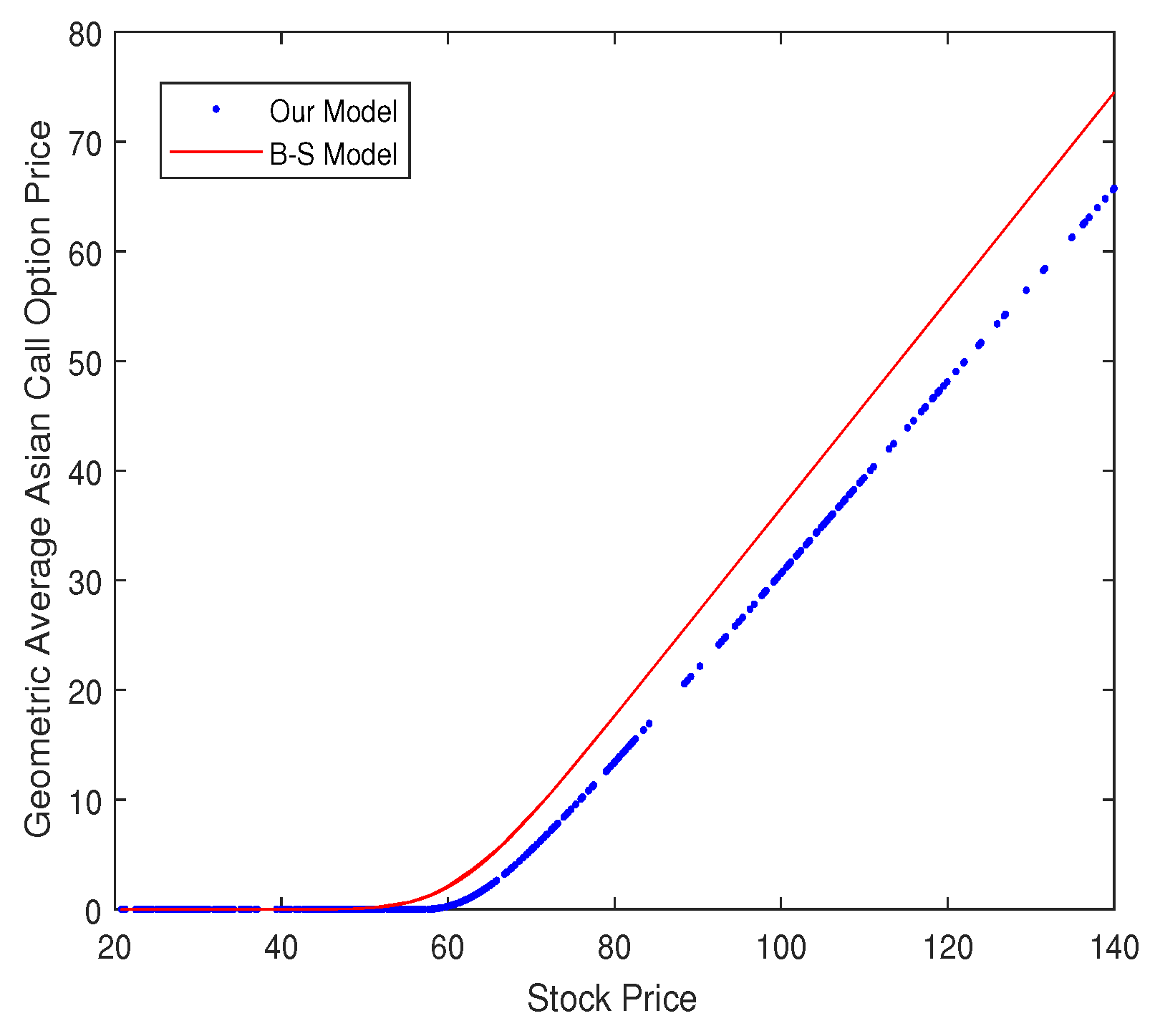

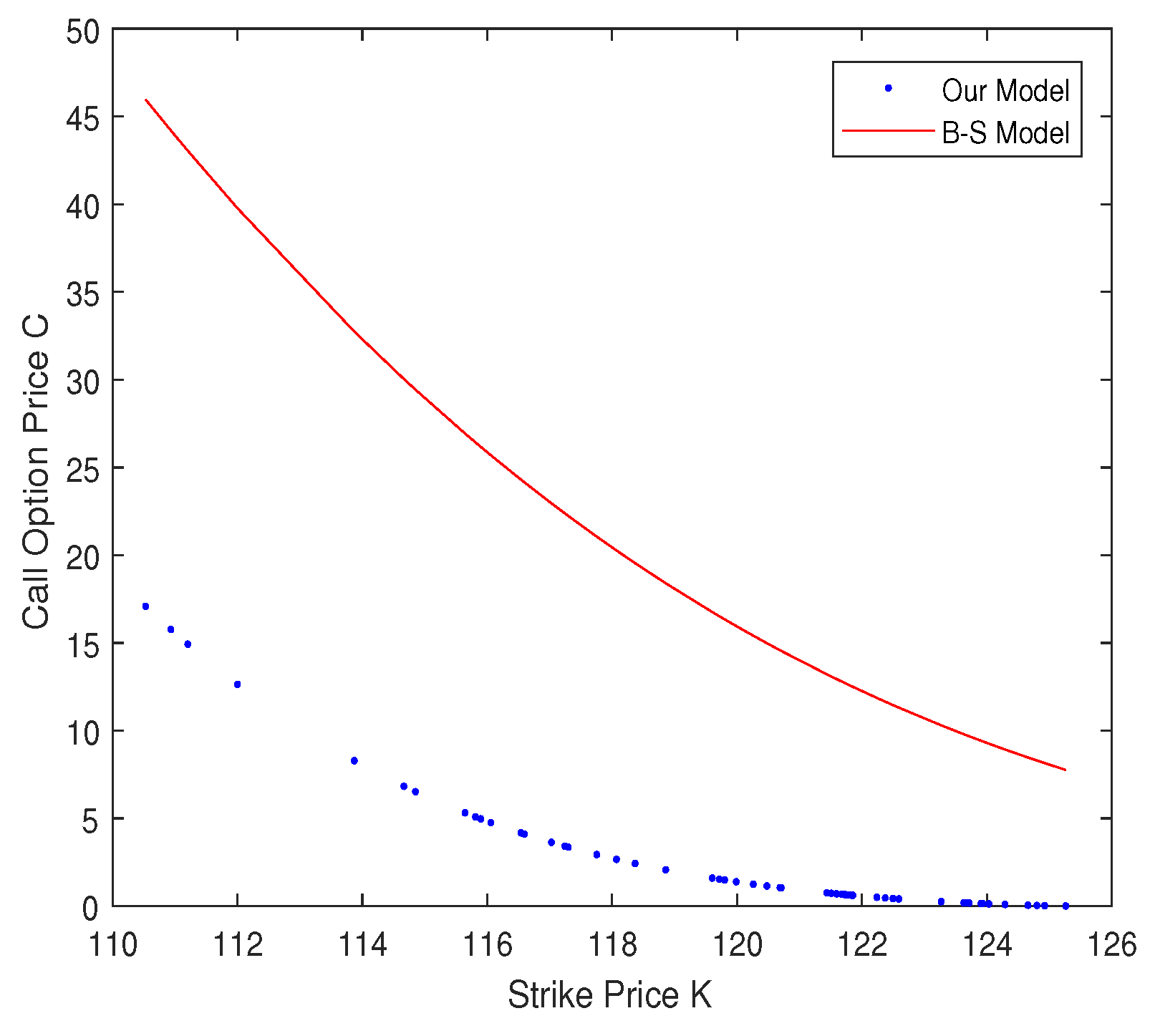

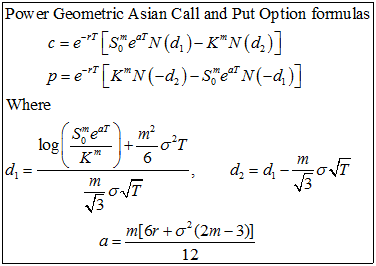

Entropy | Free Full-Text | Geometric Average Asian Option Pricing with Paying Dividend Yield under Non-Extensive Statistical Mechanics for Time-Varying Model

Entropy | Free Full-Text | Geometric Average Asian Option Pricing with Paying Dividend Yield under Non-Extensive Statistical Mechanics for Time-Varying Model

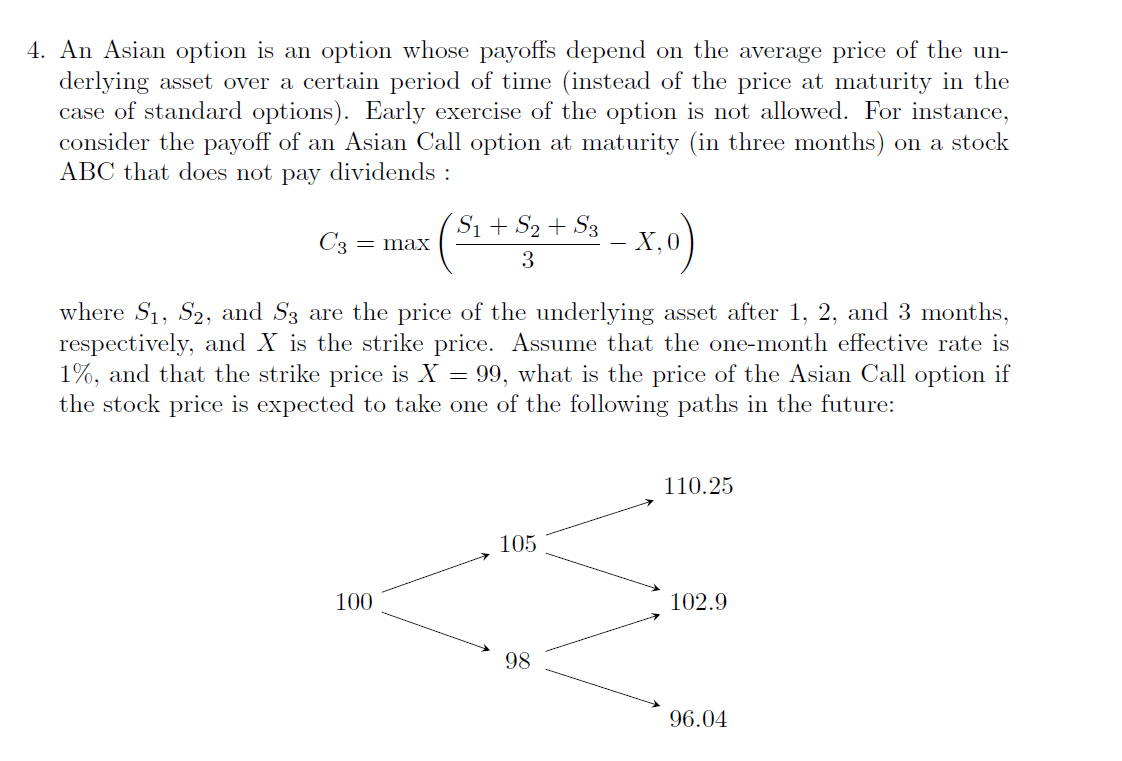

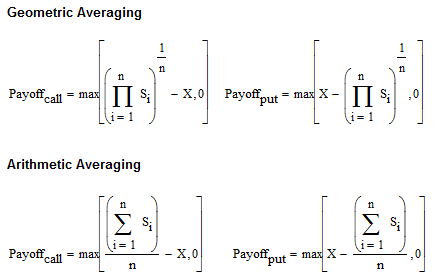

Vanilla options The payoff of a European (vanilla) option at expiry is --- call ---put where -- underlying asset price at expiry -- strike price The terminal. - ppt download

Option pricing - Exotic Options - Pricing Asian, Look backs, Barriers, Chooser Options using simulators - FinanceTrainingCourse.com

![PDF] Pricing Asian Options on Lattices | Semantic Scholar PDF] Pricing Asian Options on Lattices | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/ccebda4e95e72cec76a67d8ec8e241d1c028506a/19-Figure2.1-1.png)

![PDF] A new PDE approach for pricing arithmetic average Asian options | Semantic Scholar PDF] A new PDE approach for pricing arithmetic average Asian options | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/7868a8794409dd5b7d3b7d45fcba73d5797f9288/6-Table1-1.png)